A Step-by-Step Guide to Payment Gateway Integration into Your Website

having a seamless online payment process is crucial for the success of any e-commerce business. One of the key components of this process is integrating a payment gateway into your website. Payment gateway integration allows you to securely accept payments from your customers through various channels such as credit cards, debit cards, and online wallets. In this comprehensive guide, we will walk you through the steps involved in integrating a payment gateway into your website, ensuring a smooth and secure transaction process for your customers.

Understanding Payment Gateway Integration

Before diving into the integration process, it’s essential to understand what a payment gateway is and how it works. A payment gateway is a service that facilitates the transfer of payment information between a website and the payment processor. It encrypts sensitive data such as credit card numbers to ensure secure transactions. Payment gateways play a crucial role in enabling online transactions by authorizing payments and transferring funds between the customer’s bank and the merchant’s account.

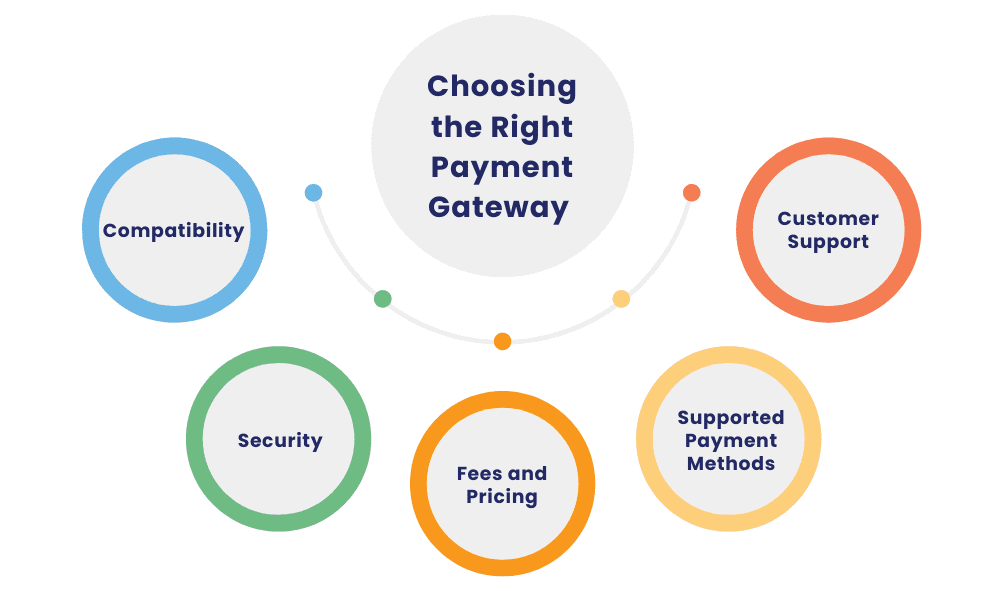

Choosing the Right Payment Gateway

The first step in integrating a payment gateway into your website is choosing the right one for your business. There are several factors to consider when selecting a payment gateway, including:

- Compatibility: Ensure that the payment gateway is compatible with your website’s platform and technology stack. Whether you’re using a custom-built website or a popular e-commerce platform like Shopify or WooCommerce, choose a payment gateway that seamlessly integrates with your existing infrastructure.

- Security: Security is paramount when it comes to online payments. Look for payment gateways that offer robust security features such as encryption, tokenization, and fraud detection to protect sensitive customer data from unauthorized access and fraudulent activities.

- Fees and Pricing: Consider the fees and pricing structure of different payment gateways, including setup fees, transaction fees, and monthly subscription fees. Compare the costs and benefits of each option to find a payment gateway that offers competitive rates without compromising on features and security.

- Supported Payment Methods: Determine which payment methods you want to offer to your customers and choose a payment gateway that supports those options. Whether you’re accepting credit cards, debit cards, or alternative payment methods like PayPal and Apple Pay, make sure the payment gateway can accommodate your needs.

- Customer Support: Reliable customer support is essential, especially when dealing with payment processing issues. Choose a payment gateway provider that offers responsive customer support and assistance to resolve any technical issues or concerns promptly.

Once you’ve evaluated your options and selected the right payment gateway for your business, it’s time to proceed with the integration process.

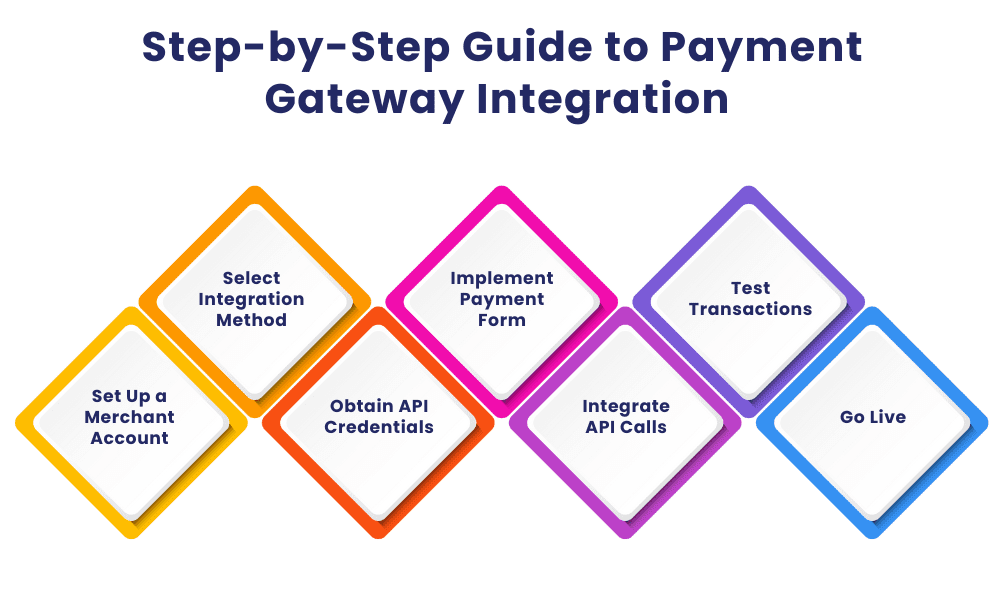

Step-by-Step Guide to Payment Gateway Integration

Integrating a payment gateway into your website may seem like a daunting task, but with the right approach, it can be a smooth and straightforward process. Follow these step-by-step instructions to seamlessly integrate a payment gateway into your website:

- Set Up a Merchant Account: Before you can start accepting payments online, you need to set up a merchant account with a payment processor or acquiring bank. A merchant account enables you to receive funds from credit and debit card transactions. Contact your chosen payment gateway provider to initiate the merchant account setup process and provide any required documentation or business details.

- Select Integration Method: Payment gateways typically offer multiple integration methods to accommodate different website platforms and technical requirements. Choose the integration method that best suits your website’s technology stack and development expertise:

- Hosted Payment Page: This method involves redirecting customers to a secure payment page hosted by the payment gateway provider. The payment page collects payment information from customers and processes transactions securely, eliminating the need to handle sensitive data on your website.

- API Integration: API (Application Programming Interface) integration allows you to embed payment processing functionality directly into your website’s checkout flow. This method offers more flexibility and customization options but requires additional development effort to implement.

- Obtain API Credentials: If you opt for API integration, you’ll need to obtain API credentials (e.g., API keys, merchant ID) from your payment gateway provider. These credentials authenticate your website’s connection to the payment gateway and enable secure communication for processing transactions.

- Implement Payment Form: If you’re using a hosted payment page, simply add a payment button or link to your website’s checkout page, directing customers to the payment gateway’s secure payment page. Customize the appearance and branding of the payment page to maintain a seamless user experience.

- Integrate API Calls: For API integration, integrate the necessary API calls into your website’s backend code to facilitate communication with the payment gateway. This includes functions to initiate transactions, capture payment details, and handle response messages such as success or failure notifications.

- Test Transactions: Before going live, thoroughly test the payment gateway integration to ensure everything is functioning correctly. Conduct test transactions using different payment methods and scenarios to simulate real-world usage and identify any issues or discrepancies.

- Go Live: Once you’ve completed testing and confirmed that the payment gateway integration is working as expected, you’re ready to go live. Update your website to enable live transactions and inform your customers that they can now make secure payments through your website.

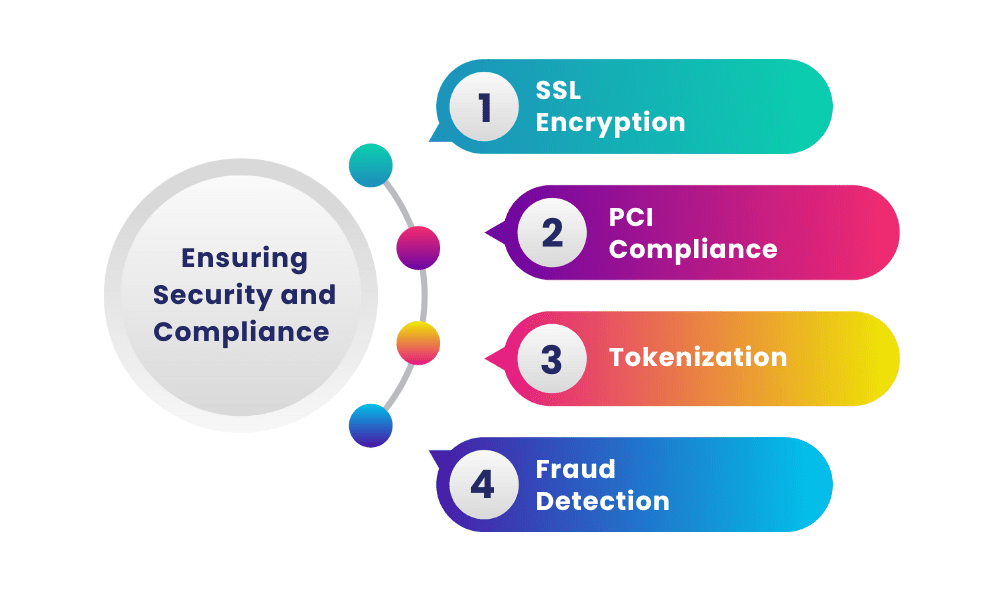

Ensuring Security and Compliance

Security is paramount when handling sensitive payment information online. As a merchant, you have a responsibility to protect your customers’ data and comply with industry standards and regulations such as the Payment Card Industry Data Security Standard (PCI DSS). Here are some essential security measures to implement:

- SSL Encryption: Secure Socket Layer (SSL) encryption encrypts data transmitted between the customer’s browser and your website, preventing unauthorized interception of sensitive information.

- PCI Compliance: Ensure your website and payment processing infrastructure comply with PCI DSS requirements to safeguard cardholder data and minimize the risk of data breaches.

- Tokenization: Implement tokenization to replace sensitive cardholder data with unique tokens, reducing the risk of data theft and simplifying PCI compliance requirements.

- Fraud Detection: Utilize fraud detection tools and algorithms to identify and prevent fraudulent transactions, protecting both your business and your customers from financial losses.

By prioritizing security and compliance measures, you can build trust with your customers and provide them with a safe and secure online shopping experience.

Conclusion

Integrating a payment gateway into your website is a critical step in establishing a reliable and secure payment process for your e-commerce business. By following the step-by-step guide outlined in this article and prioritizing security and compliance measures, you can seamlessly integrate a payment gateway into your website and provide your customers with a convenient and secure way to make online payments. Remember to choose a payment gateway that aligns with your business needs and offers the features, security, and support required to meet your customers’ expectations. With the right approach and attention to detail, you can streamline your payment process and drive success for your online business.

At Nextdynamix, We Have Pros and Peers for More Insights!

Connect with our professional web and app specialists to achieve impeccable development and seamless execution. Allow us to comprehend your industry obstacles and deliver efficient solutions, unlocking your business potential.

Contact us today for further information